ICNA Relief is Accepting Crypto Currency

Donate Crypto

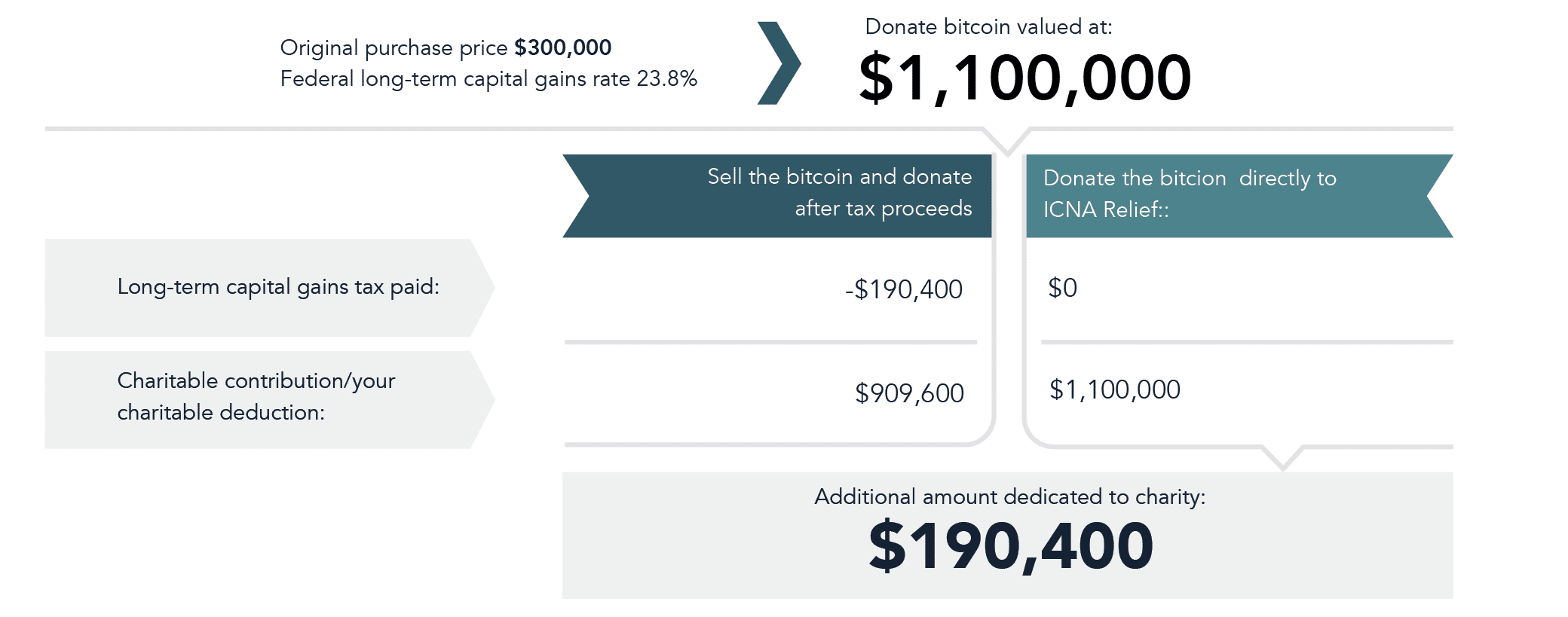

Before you sell bitcoin and donate the after-tax proceeds, consider donating your bitcoin directly to charity:

- Your tax deduction will be equal to the fair market value of the donated bitcoin (as determined by a qualified appraisal)

- Your gift to charity will be larger because instead of paying capital gains taxes, the 501(c)(3) charity will receive the full value of your contribution.

There’s another upside to donating bitcoin to a public charity with a donor-advised fund program such as ICNA Relief: The opportunity to recommend how the contribution is invested and potentially grow it tax-free, ultimately providing charitable/philanthropic support.

Donate Crypto

Before you sell bitcoin and donate the after-tax proceeds, consider donating your bitcoin directly to charity:

- Your tax deduction will be equal to the fair market value of the donated bitcoin (as determined by a qualified appraisal)

- Your gift to charity will be larger because instead of paying capital gains taxes, the 501(c)(3) charity will receive the full value of your contribution.

There’s another upside to donating bitcoin to a public charity with a donor-advised fund program such as ICNA Relief: The opportunity to recommend how the contribution is invested and potentially grow it tax-free, ultimately providing charitable/philanthropic support.

Frequently Asked Questions

Why donate cryptocurrency?

When you donate crypto to a registered charity, you do not recognize capital gains from the donation and can deduct it from your taxes. In other words, donating your crypto can often reduce your tax burden. Would you rather donate to the IRS or your favorite cause?

Is my cryptocurrency donation tax deductible?

Yes, your cryptocurrency donation is tax deductible! ICNA Relief offers supporters with cryptocurrency the ability to support the organization in a tax-efficient way. The IRS classifies cryptocurrency donations as property, meaning they are not subject to capital gains taxes and are tax-deductible. Your contribution is tax-deductible to the fullest extent permitted by the law. For example, for donors in the United States, the IRS has classified Bitcoin as property for tax purposes. This means when you donate Bitcoin and other cryptocurrencies to a 501(c)(3) nonprofit like ICNA Relief, you do not have to pay capital gains tax and it is tax-deductible if you provide your email address.

*Please consult your tax advisor. You can donate anonymously but you will not receive a tax receipt

Join our mission. Volunteer, Donate, Advocate. Get Started Today.

Email: office@icnarelief.org

Call Anytime: 866-354-0102